Broomfield Sales Tax Form . The following state forms are provided for your convenience. Sales tax return (for special event) claim for refund lodging tax return. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Please mail or deliver the completed forms to the colorado department of revenue,. Look up any broomfield tax rate and calculate tax based on address. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. 1267 colorado tax forms and templates are collected for any of your needs. Single point of remittance and a uniform remittance form. 1267 colorado tax forms and. Accurately look up sales and use tax rates by address. State of colorado, rtd/cd, and the.

from www.formsbank.com

Look up any broomfield tax rate and calculate tax based on address. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. 1267 colorado tax forms and. 1267 colorado tax forms and templates are collected for any of your needs. State of colorado, rtd/cd, and the. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. Please mail or deliver the completed forms to the colorado department of revenue,. Single point of remittance and a uniform remittance form. The following state forms are provided for your convenience.

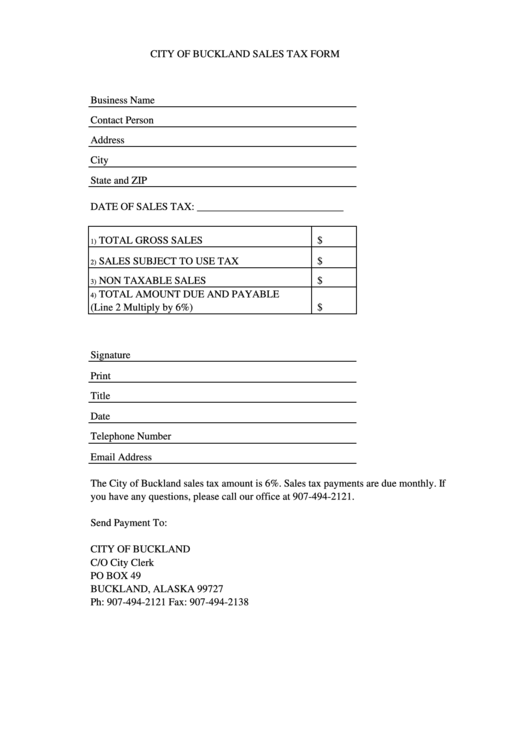

Sales Tax Form City Of Buckland printable pdf download

Broomfield Sales Tax Form The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Please mail or deliver the completed forms to the colorado department of revenue,. Accurately look up sales and use tax rates by address. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. 1267 colorado tax forms and. Single point of remittance and a uniform remittance form. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. The following state forms are provided for your convenience. 1267 colorado tax forms and templates are collected for any of your needs. State of colorado, rtd/cd, and the. Look up any broomfield tax rate and calculate tax based on address. Sales tax return (for special event) claim for refund lodging tax return.

From www.formsbank.com

Sales Tax Return Form City And County Of Broomfield printable pdf download Broomfield Sales Tax Form Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. The following state forms are provided for your convenience. Sales tax return (for special event) claim for refund lodging tax return. Accurately look up sales and use tax rates by address. 1267 colorado tax forms and. Look up any broomfield tax rate and calculate tax based on address.. Broomfield Sales Tax Form.

From www.formsbank.com

Sales Tax Form City Of Buckland printable pdf download Broomfield Sales Tax Form 1267 colorado tax forms and. State of colorado, rtd/cd, and the. 1267 colorado tax forms and templates are collected for any of your needs. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. Sales tax return (for special event) claim for refund lodging tax return. Accurately. Broomfield Sales Tax Form.

From www.dochub.com

Oklahoma sales Fill out & sign online DocHub Broomfield Sales Tax Form 1267 colorado tax forms and. Single point of remittance and a uniform remittance form. Look up any broomfield tax rate and calculate tax based on address. Sales tax return (for special event) claim for refund lodging tax return. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Accurately look up sales and. Broomfield Sales Tax Form.

From www.formsbank.com

Sales And Tax Return City Of Greeley printable pdf download Broomfield Sales Tax Form Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. 1267 colorado tax forms and templates are collected for any of your needs. Sales tax return (for special event) claim for refund lodging tax return. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Accurately look up sales and use. Broomfield Sales Tax Form.

From www.formsbank.com

Sales Tax Return Template printable pdf download Broomfield Sales Tax Form State of colorado, rtd/cd, and the. Look up any broomfield tax rate and calculate tax based on address. Please mail or deliver the completed forms to the colorado department of revenue,. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Accurately look up sales and use tax rates by address. Sales tax. Broomfield Sales Tax Form.

From www.formsbank.com

City And County Sales/use Tax Return Form Alabama Sales Tax Division printable pdf download Broomfield Sales Tax Form Accurately look up sales and use tax rates by address. 1267 colorado tax forms and. The following state forms are provided for your convenience. State of colorado, rtd/cd, and the. 1267 colorado tax forms and templates are collected for any of your needs. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. Sales tax return (for special. Broomfield Sales Tax Form.

From edit-pdf.dochub.com

Missouri sales tax form 53 1 instruction 2011 Fill out & sign online DocHub Broomfield Sales Tax Form State of colorado, rtd/cd, and the. The following state forms are provided for your convenience. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. Sales tax return (for special event) claim for refund lodging tax return. Look up any broomfield tax rate and calculate tax based. Broomfield Sales Tax Form.

From www.formsbank.com

Refund Claim For Sales Tax Paid City And County Of Broomfield printable pdf download Broomfield Sales Tax Form Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. Single point of remittance and a uniform remittance form. 1267 colorado tax forms and. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. The following state forms are provided for your convenience. Please mail or deliver the completed forms to. Broomfield Sales Tax Form.

From blanker.org

Form DR15. Sales and Use Tax Return Forms Docs 2023 Broomfield Sales Tax Form Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. Single point of remittance and a uniform remittance. Broomfield Sales Tax Form.

From www.formsbank.com

Sale Taxes Form City Of Lone Tree printable pdf download Broomfield Sales Tax Form Look up any broomfield tax rate and calculate tax based on address. 1267 colorado tax forms and templates are collected for any of your needs. Single point of remittance and a uniform remittance form. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. Please mail or deliver the completed forms to the colorado department of revenue,. The. Broomfield Sales Tax Form.

From www.formsbank.com

Supplemental Sales And Tax Report Shreveport printable pdf download Broomfield Sales Tax Form 1267 colorado tax forms and. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. Sales tax return (for special event) claim for refund lodging tax return. 1267 colorado tax. Broomfield Sales Tax Form.

From www.reportform.net

Sales Tax Report Form Texas Broomfield Sales Tax Form Accurately look up sales and use tax rates by address. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. 1267 colorado tax forms and. Look up any broomfield tax rate and calculate tax based on address. Single point of remittance and a uniform remittance form. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state. Broomfield Sales Tax Form.

From www.formsbank.com

Sales Tax License Application Form City And County Of Broomfield printable pdf download Broomfield Sales Tax Form 1267 colorado tax forms and templates are collected for any of your needs. Please mail or deliver the completed forms to the colorado department of revenue,. 1267 colorado tax forms and. State of colorado, rtd/cd, and the. The following state forms are provided for your convenience. Accurately look up sales and use tax rates by address. The 8.6% sales tax. Broomfield Sales Tax Form.

From www.signnow.com

St 1 X 20182024 Form Fill Out and Sign Printable PDF Template airSlate SignNow Broomfield Sales Tax Form Sales tax return (for special event) claim for refund lodging tax return. The total sales tax rate for the city and county of broomfield (excluding special districts) is 8.15%. 1267 colorado tax forms and. State of colorado, rtd/cd, and the. The following state forms are provided for your convenience. Please mail or deliver the completed forms to the colorado department. Broomfield Sales Tax Form.

From www.formsbank.com

Refund Claim For Sales Tax Paid Form City And County Of Broomfield printable pdf download Broomfield Sales Tax Form State of colorado, rtd/cd, and the. 1267 colorado tax forms and. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. Sales tax return (for special event) claim for refund lodging tax return. Look up any broomfield tax rate and calculate tax based on address. 1267 colorado tax forms and templates are collected for any of your needs.. Broomfield Sales Tax Form.

From www.youtube.com

Tax Accountant Broomfield Co For Tax Preparation And Tax Return Services Broomfield Colorado Broomfield Sales Tax Form Accurately look up sales and use tax rates by address. 1267 colorado tax forms and. State of colorado, rtd/cd, and the. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. Look up 2024 sales tax rates for broomfield, colorado, and surrounding areas. The following state forms. Broomfield Sales Tax Form.

From www.pdffiller.com

2018 Form NY DTF ST100 Fill Online, Printable, Fillable, Blank pdfFiller Broomfield Sales Tax Form Look up any broomfield tax rate and calculate tax based on address. The following state forms are provided for your convenience. The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. The total sales tax rate for the city and county of broomfield (excluding special districts) is. Broomfield Sales Tax Form.

From www.formsbank.com

Sales Tax License Application Form City And County Of Broomfield printable pdf download Broomfield Sales Tax Form The 8.6% sales tax rate in broomfield consists of 2.9% colorado state sales tax, 0.75% broomfield county sales tax, 3.85% broomfield tax and. Please mail or deliver the completed forms to the colorado department of revenue,. Accurately look up sales and use tax rates by address. The total sales tax rate for the city and county of broomfield (excluding special. Broomfield Sales Tax Form.